Edmunds TMV the Magic Number

Edmunds.com

Member, Administrator, Moderator Posts: 10,316

Edmunds.com

Member, Administrator, Moderator Posts: 10,316

Edmunds TMV the Magic Number

Edmunds TMV the Magic Number

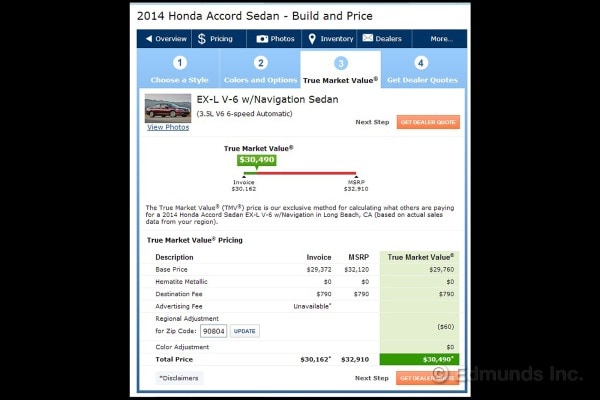

Edmunds.com's True Market Value (TMV) is a powerful tool for car buyers and sellers. Here's how to use it to get a great deal on a new or used car.

0

Comments

Philip Reed, Senior Consumer Advice Editor

Philip Reed, Edmunds.com Senior Consumer Advice Editor

Also, when do I factor in the trade-in value of my car. I thought I should negotiate price first and then bring up trade-in, but maybe not. If they give a better than expected price for trade-in (one dealership has looked at my car and given a number that is good based on Edmunds and KBB), can I still expect TMV?

Your trade-in is a separate deal but it's hard to keep the new car purchase and the trade from intertwining. If you know the TMV of your trade, and the TMV of the new car, you can look at the bottom line and see if you are getting an ok deal or not.

If I were to come in and ask for a Cruze and avoid all the salesmen BS, why would I need to pay msrp?

Why do salesmen require the buyers to pay you for your hard work? That's your employers duties not the customers.

I've met many nice folks and

With TMV in hand, I invited quotes from four Kia dealerships, all through the Internet. A couple of the Web sites required me to enter my phone number but I specified that if either Kia dealer contacted me I would immediately eliminate them from consideration.

Previously, I had read numerous car-buying articles on Edmunds, and one said that shopping by Internet eliminated pressure from the car-buying experience. Made sense to me and it worked.

My state is North Carolina. My residence is in the middle of NC (the “piedmont”), so I invited quotes from one dealer in the eastern part of NC, one in the western part, and two in the piedmont – one near my home and one farther away. Western Kia’s Web site boldly proclaimed WE WILL NOT BE UNDERSOLD!!! PERIOD!!! The salesman from that dealership “backed-up” that claim with identical numerous email claims.

With my TMV stealthily in the background, I began assessing the value of the four quotes I had received. Eastern Kia came in BELOW Edmunds TMV. (I had only revealed to Western Kia that I had the TMV.) The two piedmont quotes were more than eastern’s but western Kia (read, “We will not be Undersold”) came in WAY higher – after adding more than a thousand dollars for “dealer prep” to their quote. Confronted with not only my TMV but with my lower eastern quote (all through email, mind you), the western dealer threw his little tantrum and said, “if you can buy that car at that price, you better do it.” I did it. But not with the eastern quote.

Eastern Kia had a great price but began low-balling me about the value of my trade-in car – much less than the KBB value and lower than my Edmunds’ vehicle trade-in allowance estimate – effectively raising their price and lowering their quote by lowering my trade-in value.

Decision day arrived for me. "In my heart," I really wanted to buy from the Kia dealer nearest me because that’s where I would have the Kia serviced and they had the car with the color of my choice (eastern dealer’s car was a color I didn’t want but could live with). But, hey, dollars are dollars, so I was all ready to buy from eastern. Just as a courtesy and, literally at the last moment, though (and because I would be getting my car serviced there), I telephoned the nearest dealership and said something like, “hey, I really appreciate your price quote, but dollars are dollars and I’ve got to buy from eastern Kia because their quote is so much lower – and don’t worry, you did your best but you can’t possibly match their quote.” They did.

In fact, they even beat eastern’s already below-Edmunds-TMV quote by $500’; gave me the color of my choice; equipped the car better than eastern’s car; gave me a lifetime powertrain warranty, good at any Kia dealership; and gave me free oil changes for life. (Gerry Wood Kia, Salisbury, NC.)

All of that Internet research and dealing took me about one week. But it saved me about $3,500. And EDMUNDS IS DUE THE CREDIT!

So do your homework, use the Edmunds site, take your time, use the power of the Internet, do not be pushed, do not be intimidated, do not be BS’d. It may save you thousands of dollars.

Enjoy your car purchase and feel a justified sense of pride by not being "taken for a ride."

I really do love the TMV!!! It is a great tool to use when you have a customer sitting in front of you and you can show them the TMV of their car!

Thank you Edmunds for all you do!

When you buy a car the salesman is your very best friend until you drive off. If you need to return for any warranty issues with your car you will find out that you will be treated like a migrant worker at the country club. Not only do they not want you there, they can't understand what you are saying. That is until the warranty expires or you are shopping for another vehicle. Then the magic translator is deployed once again.

As I said the bottom line is the bottom line for the dealer. Shouldn't it be for the customer also?

Now, I've been fortunate to have met some people who just want to feel like they got a deal, so discounting a few hundred bucks is all they ask. But then you get these ridiculous offers where I will tell a customer that the invoice is $18000 and they will go ahead and say they will not pay a dime over $15000...how does that mathematically make sense? It's the equivalent of me going into a liquor store, telling the clerk I refuse to pay $0.99 for a candy bar, but instead want to pay LESS than what he paid for via mass order. So I've come up with a resolution...if customers want to continue haggling and negotiating...FINE. I've made it my life ambition to haggle and negotiate at every vendor I go to...be in the local gas station where I refuse to pay $4.00 a gallon, instead I will demand $2.00. Etc. and so on...you consumers have this self-righteous idea that you can do that at a dealership, so why can't we as people who have a right to make a living to feed our families do it at YOUR businesses? Why should I pay MSRP on an Apple iPad? I know it probably only cost about $30 to make...therefore...i want to pay $15 for it!

When a consumer finances a car, the bank writes the dealer ONE check and the consumer then owes the money to the bank--not the dealer. This is true even with Toyota Finance or GMAC. If your dealer is paying your commission on installment, then you can't blame the customer.

Why would anyone feel bad for the salesman? This is business.

When a consumer finances a car, the bank writes the dealer ONE check and the consumer then owes the money to the bank--not the dealer. This is true even with Toyota Finance or GMAC. If your dealer is paying your commission on installment, then you can't blame the customer.

Why would anyone feel bad for the salesman? This is business.

You CAN actually go lower. ALWAYS insist on below invoice. Then work up from there.

ALWAYS check the Dealer Fee. Don't step foot into a competing dealer until you get that.It used to be around $299 many years ago. NOW it can be as high as 799.00 ( Volkswagen loves it).

Dealers would love to do a fast sale because they are adding on NON_NEGOTIABLE "straight to the owner" $500 profit. Times 40 cars a month.....show him your MONEY!