By accessing this website, you acknowledge that Edmunds and its third party business partners may use cookies, pixels, and similar technologies to collect information about you and your interactions with the website as described in our

Privacy Statement, and you agree that your use of the website is subject to our

Visitor Agreement.

Comments

Couple notes since I’ve done this twice during this crazy time.

1: Prepare for closing to be delayed. Banks are overwhelmed and often miss the clear to close. The buyers of our home missed, and we nearly missed on the Wildwood house.

2: 100% find the home you want with offer accepted and then put yours on the market.

3: On the selling front, after the initial surge of showings just mark a line in the sand and let the realtor do a “highest and best” by X date and time

4: Prepare a plan if either home doesn’t appraise. With values the way they are it’s more common than ever for the appraisal to not be inline with the current value if the comps aren’t there

2025 Ram 1500 Laramie 4x4 / 2023 Mercedes EQE 350 4Matic / 2022 Icon I6L Golf Cart

I don’t think this is the case. It may slow the escalation in prices but values won’t go down. There isn’t enough inventory to match demand. Builders aren’t building nearly as many new homes so the existing market will remain hot.

Rates are increasing. The sub 3% 30 years are gone. Most are around 4.5 right now.

2025 Ram 1500 Laramie 4x4 / 2023 Mercedes EQE 350 4Matic / 2022 Icon I6L Golf Cart

I’ve been watching clips from the movie The Big Short on YT and it’s a great statement on economic bubbles.

2015 Mustang GT, 2013 Ford F-150, 2010 Ford Fusion SEL, 2000 Chrysler Sebring convertible

I don't think mortgage rates will rise as fast as the Fed rate. They've already gone up 3/4%, even before the Fed's 1/4% hike.

30 yr mortgages tend to follow the 10-yr T-bond rate. That's only expected to rise about 1% more, this year.

Of course, give it another year, and who knows?

Edmunds Price Checker

Edmunds Lease Calculator

Did you get a good deal? Be sure to come back and share!

Edmunds Moderator

2001 Prelude Type SH, 2022 Highlander XLE AWD, 2025 Camry SE AWD, 2025 Integra

2024 Jeep Grand Cherokee L Limited Velvet Red over Wicker Beige

2024 Audi Q5 Premium Plus Daytona Gray over Beige

2017 BMW X1 Jet Black over Mocha

2015 Mustang GT, 2013 Ford F-150, 2010 Ford Fusion SEL, 2000 Chrysler Sebring convertible

Yeah for once we timed the market pretty well. 2.75% on one home and 3.125% on the other. At the time 3.125 was as low as it got for second homes.

Of course we paid heavily for both houses but also sold the other two very high as well. Who knows if any of it was the right decision but we are very happy with everything and I guess that is all that matters.

2025 Ram 1500 Laramie 4x4 / 2023 Mercedes EQE 350 4Matic / 2022 Icon I6L Golf Cart

Yeah for once we timed the market pretty well. 2.75% on one home and 3.125% on the other. At the time 3.125 was as low as it got for second homes.

Of course we paid heavily for both houses but also sold the other two very high as well. Who knows if any of it was the right decision but we are very happy with everything and I guess that is all that matters.

If you're happy, it was the right decision.

2025 Forester Limited, 2024 Subaru Legacy Sport

2017 Cadillac ATS Performance Premium 3.6

2015 Mustang GT, 2013 Ford F-150, 2010 Ford Fusion SEL, 2000 Chrysler Sebring convertible

2017 Cadillac ATS Performance Premium 3.6

Yeah for once we timed the market pretty well. 2.75% on one home and 3.125% on the other. At the time 3.125 was as low as it got for second homes.

Of course we paid heavily for both houses but also sold the other two very high as well. Who knows if any of it was the right decision but we are very happy with everything and I guess that is all that matters.

We re-fi’ed the lake house last year and got 3.25.

2024 Jeep Grand Cherokee L Limited Velvet Red over Wicker Beige

2024 Audi Q5 Premium Plus Daytona Gray over Beige

2017 BMW X1 Jet Black over Mocha

2021 VW Arteon SEL 4-motion, 2018 VW Passat SE w/tech, 2016 Audi Q5 Premium Plus w/tech

'21 Dark Blue/Black Audi A7 PHEV (mine); '22 White/Beige BMW X3 (hers); '20 Estoril Blue/Oyster BMW M240xi 'Vert (Ours, read: hers in 'vert weather; mine during Nor'easters...)

'21 Dark Blue/Black Audi A7 PHEV (mine); '22 White/Beige BMW X3 (hers); '20 Estoril Blue/Oyster BMW M240xi 'Vert (Ours, read: hers in 'vert weather; mine during Nor'easters...)

2.375% for 30 here after refi. Bought at 3.375. Never selling it with money this cheap.

I only care about interest rates in terms of what they do to the market. I will only have a large balance temporarily (if we carry 2 houses). Once the old one sells, the equity goes to the new mortgage. So should end up somewhere between 0 and 100K, but getting paid off in 2-3 years anyway. so the extra interest will just not be all that much to us. A 500k loan for 30 years, that will add up!

would be wonderful to get both under contract and close on the old place first like L'sDD did. That is the dream. Not really expecting it though. But these days, who knows.

I can say it is nice to have a transition window. This house we had about 2 months before the prior one sold. Was able to get most of the interior painted when it was empty, which is nice. Would probably rent the big Uhaul and drive up a load of extra stuff to closing, and get a head start on that process. Then have the rest moved at the end. Basically get enough stuff there to make it a functioning house while we are up getting it ready!

2020 Acura RDX tech SH-AWD, 2023 Maverick hybrid Lariat luxury package.

On extended warranties, I believe BMW let’s you extend your warranty on an annual basis.

Mine: 1995 318ti Club Sport-2020 C43-1996 Speed Triple Challenge Cup Replica

Wife's: 2021 Sahara 4xe

Son's: 2018 330i xDrive

I wouldn’t guess the housing market will take a dive this time around, but hard to predict what will happen with so many different factors…40 year high inflation, the threat of war. I think rising mortgage rates will have an impact on the higher end of the market more than anything…folks will choose not to stretch as much. As @kyfdx mentioned, the rising rate environment has already been baked into the mortgage rates, as they tend to react to merely the mention of increases (and there’s been a lot of that for several months).

@stickguy - we had a great product from a local credit union to bridge the purchase of our new house last fall, where they financed 90% of the new home and then when we closed on the sale a few weeks later we were able to pay a large portion down and recast the loan with the new amortization.

2025 BMW i5 - 2017 911 C4S - 2024 BMW 230i - 2025 MB GLE450e - 2024 Genesis GV60 - 2019 Cayman

I like looking at 80s era rates, and also seeing how prices then related to incomes, and what banks were offering in simple money market accounts and CDs compared to now.

I talked to the woman who ran the company credit union, a person I had known personally for better than 20 years. She told me she would love to do it, but legally she was not permitted to do so. She could loan me $50k (or more) to buy a new car. With terms from 2 to 7 years. And at an interest rate quite a bit lower than the going rate at that time for mortgages. But she was not allowed to loan money against a house. Laws.

I wound up pulling the money out of my 401. I had just turned 59 and a half, so I could pull the money without paying a penalty. Income taxes, yes, penalty, no. And I believe I have mentioned before how amazingly easy it is to close on a house with no mortgage lender involved. I have dealt with four closings over the course of my life, the other three took hours and lead to writer’s cramp from signing so many forms. With no mortgage, turn over the cashier’s check, sign twice, over and done in less than 5 minutes.

I did not have to pay for title insurance, nor a survey. I felt pretty sure there would be no title problems buying the house straight from HUD. And no inspection by a licensed professional, I did my own inspection, thank you.

Our under construction house, with construction loan, is 3.25% for 30 years.

Local MB dealer has zero new cars in stock, inventory consists of a 11 CUVs/SUVs and a Sprinter. They have a few actual used cars, at prices that make my buyout look like a real steal.

Current house is a bit higher at 4.75%, but I'm looking to refinance and drop PMI before rates get out of hand. My mortgage broker seems to think that's possible, so I can save a few hundred a month.

Folks are posting questions in the lease threads asking about money factor hikes due to the Fed actions this week. Told them that's not how the lease market works.

FWIW, BMW MF was .00093 last September. This month, it's .00158.

All these folks who order cars and can't lock in the terms are gonna be shocked when their car arrives at the dealer, and find the lease payment is $25/$50/$100 month more than they budgeted.

Many more folks are looking to buy with low APR's (at the moment).

Edmunds Price Checker

Edmunds Lease Calculator

Did you get a good deal? Be sure to come back and let us know! Post a pic of your new purchase or lease!

MODERATOR

2015 Subaru Outback 3.6R / 2024 Kia Sportage Hybrid SX Prestige

I discussed options with the mortgage broker that gave me the pre-auth (great guy, been in the business for 30 years). I asked about any kind of bridge loan or program, and he said they have not had anything like that in many years. A CU, they might have different stuff. He said that most people now just get the new mortgage for a bigger amount, and pay down principal when the old house sells.

the other option people use (if the old place has enough equity) is just take out a huge home equity loan, and use that to buy the new place. Then it gets paid off at closing on the old house, and you are a cash buyer on the new one. Just something you need some lead time to get done.

2020 Acura RDX tech SH-AWD, 2023 Maverick hybrid Lariat luxury package.

First house in 2000 was, IIRC, 5.25 or 5.5 30-yr fixed. 2nd house in 2004 was maybe 4.875? 2015 3rd house started at 3.75 and re-fi’d last Sept at 2.875, 30-yr fixed, 80% LTV.

'11 GMC Sierra 1500; '98 Alfa 156 2.0TS; '08 Maser QP; '67 Coronet R/T; '13 Fiat 500c; '20 S90 T6; '22 MB Sprinter 2500 4x4 diesel; '97 Suzuki R Wagon; '96 Opel Astra; '07 Vespa 200GT

And no, I’m not trying to sell you my place.🤑

2015 Mustang GT, 2013 Ford F-150, 2010 Ford Fusion SEL, 2000 Chrysler Sebring convertible

As for car satisfaction, well, I try not to hold repair needs against my cars. I mean, they're cars. Yes, the Audi dealer in Anchorage consists of a bunch of cheap, incompetent boobs, but now that I'm out of warranty and decided to not pursue having them fix warranty issues, I'm at peace with the whole thing.

I'll hit 125,000 with the Q7 later today.

The folks from whom we bought our house last year had to have it sold before they could close on their other place simply because they couldn't actually afford it. Granted, they made out like bandits on the sale, but they were determined to go from the frying pan directly into the fire. Hahaha!

I wish I could get a handle on M2 prices; I know they won't hold as steady as 1M prices but I'm beginning to think that they won't drop an appreciable amount before they hold steady and start to appreciate.

Mine: 1995 318ti Club Sport-2020 C43-1996 Speed Triple Challenge Cup Replica

Wife's: 2021 Sahara 4xe

Son's: 2018 330i xDrive

2020 Acura RDX tech SH-AWD, 2023 Maverick hybrid Lariat luxury package.

so Ford got tired of it and said sure, we will send out an update. And that is what we got. No specifics, just reiterating that there are delays and commodity constraints, so you just have to be patient and will eventually get a truck. eventually.

2020 Acura RDX tech SH-AWD, 2023 Maverick hybrid Lariat luxury package.

Mine: 1995 318ti Club Sport-2020 C43-1996 Speed Triple Challenge Cup Replica

Wife's: 2021 Sahara 4xe

Son's: 2018 330i xDrive

2020 Acura RDX tech SH-AWD, 2023 Maverick hybrid Lariat luxury package.

Edmunds Price Checker

Edmunds Lease Calculator

Did you get a good deal? Be sure to come back and share!

Edmunds Moderator

2020 Acura RDX tech SH-AWD, 2023 Maverick hybrid Lariat luxury package.

2015 Mustang GT, 2013 Ford F-150, 2010 Ford Fusion SEL, 2000 Chrysler Sebring convertible

2020 Acura RDX tech SH-AWD, 2023 Maverick hybrid Lariat luxury package.

2025 Ram 1500 Laramie 4x4 / 2023 Mercedes EQE 350 4Matic / 2022 Icon I6L Golf Cart

My experience with hoopties mirrors that but with domestic cars reaching the bottom of the curve between 15-18 years.

2015 Mustang GT, 2013 Ford F-150, 2010 Ford Fusion SEL, 2000 Chrysler Sebring convertible

2024 Jeep Grand Cherokee L Limited Velvet Red over Wicker Beige

2024 Audi Q5 Premium Plus Daytona Gray over Beige

2017 BMW X1 Jet Black over Mocha

2015 Mustang GT, 2013 Ford F-150, 2010 Ford Fusion SEL, 2000 Chrysler Sebring convertible

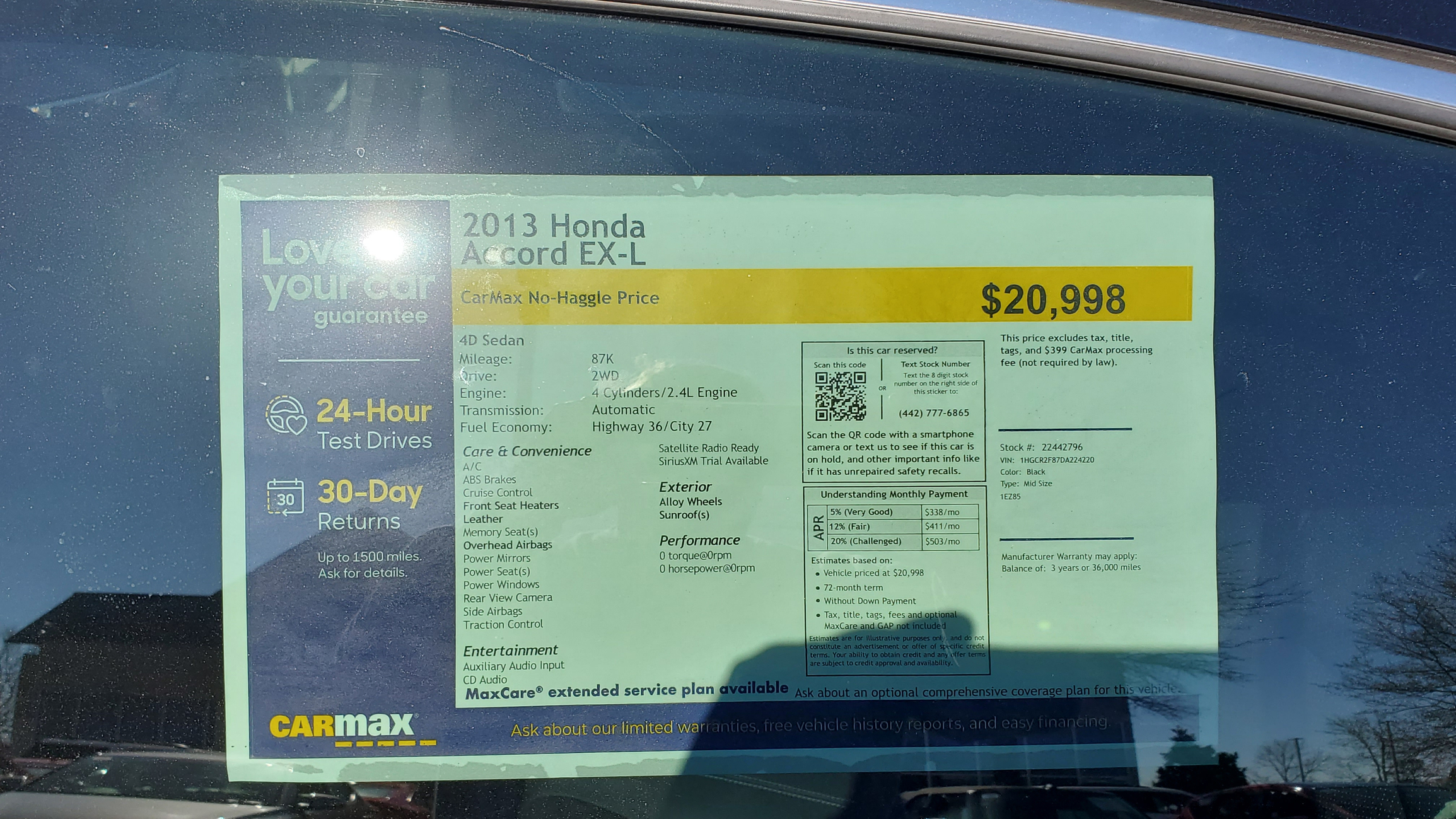

Insane pricing.

2021 VW Arteon SEL 4-motion, 2018 VW Passat SE w/tech, 2016 Audi Q5 Premium Plus w/tech